EXCLUSIVE: The concept of channel surfing appears to be going out with the tide. Rather than flipping on live TVto see what’s on, viewers are increasingly defaulting to on-demand sources like SVODservices, according to a new study by HubEntertainment Research.

In the latest edition of its annual “Decoding the Default” report, Hub found that only 39% of viewers tune into live programming from a traditional pay-TVprovider, down from 47% last year. On-demand sources, collectively, were the first choice for 48% of viewers.

“That’s not the same thing as saying people never watch live TV,” said Jon Giegengack, a principal at Hub who is one of the authors of the study, in an interview with Deadline. “But it shows that people have been conditioned that SVODs are the inverse of appointment TV. They can watch it when they want.”

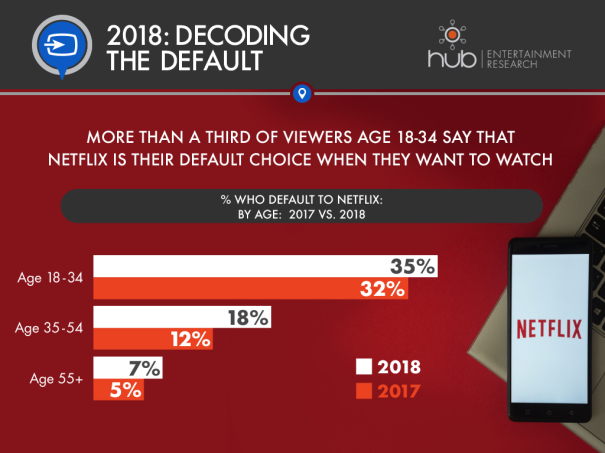

For viewers aged 18-34, the pattern is more stark — only about a quarter (26%) of the demo lists live TV as a default, compared with 35% a year ago.

One clear influence on consumer behavior is the increase in TV sources — the average person has 4.5 distinct sources to choose from (including linear TV, DVR, VOD, Netflix, etc.). That number is up from 3.7 in 2014. Among viewers 18-34, the number is higher, at 5.1 sources — plus, Hub found that fully 50% of 18-34-year-olds subscribe to at least two of the “big three” SVOD services, Netflix, Amazon or Hulu.

Even older generations accustomed to the “clicker” have turned away from live TV as a default. About 56% of viewers 55 and older listed live as their first choice, but that’s down from 66% a year ago.

“We’ve been watching live TV drop steadily as a default source since we first conducted this study in 2013,” said Peter Fondulas, a principal at Hub and co-author of the study. “But this is the first year where we’ve seen a sharp drop among older consumers too, which has huge implications for the monetization of linear TV in general. As online, on-demand platforms continue to become mainstream, live viewing has become the exception rather than the rule.”

The study is based on data collected in June from 1,933 US consumers with broadband who watch at least one hour of TV per week. One significant change in methodology from the 2017 study, Giegengack said, is the use of the one-hour threshold. Hub used to use five hours of viewing a week, which skewed results toward more avid TV viewers.

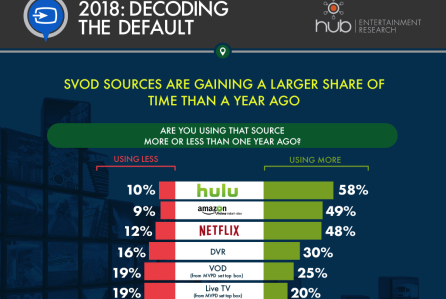

The battle of the streaming services revealed some interesting results in the study. The number of viewers who said they are using Hulu more than they were a year ago reached 58%, compared with 48% for Netflix. (Call it the Handmaid’seffect.) Also, 12% of viewers said they are using Netflix less than a year ago, compared with 10% who reported using Hulu less.