Netflix has established a substantial foothold in the American living room — especially among millennials.

The subscription-video service is now the most popular platform for watching entertainment on TV, ahead of traditional cable and broadcast television networks as well as YouTube and Hulu, according to a recent survey of U.S. consumers by Wall Street firm Cowen & Co.

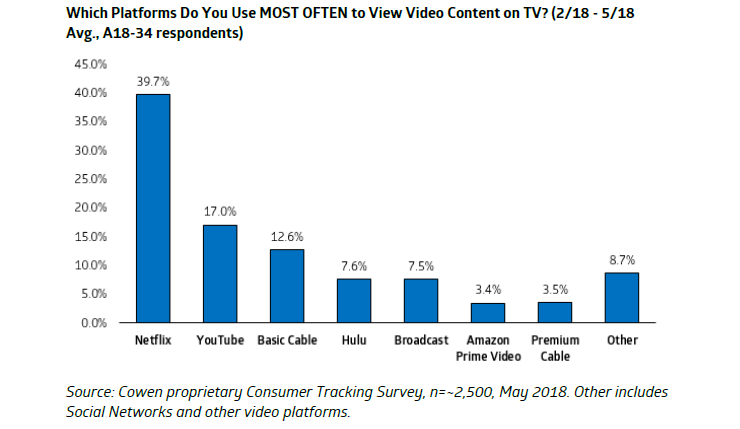

For the survey of 2,500 U.S. adults conducted in May, Cowen & Co. asked, “Which platforms do you use most often to view video content on TV?” Overall, Netflix captured the No. 1 with 27% of total respondents, followed by basic cable at 20%, broadcast at 18% and YouTube at 11%.

When looking at adults 18-34, Netflix’s lead is even more dramatic: Nearly 40% of those in the younger demo said Netflix is the platform they use most often to view video content on their TVs — well ahead of YouTube (17%), basic cable (12.6%), Hulu (7.6%) and broadcast TV (7.5%).

Among Americans who subscribe to traditional pay-TV service (i.e., excluding cord-cutters and cord-nevers), basic cable came out on top as the top choice for TV viewing on Cowen & Co.’s survey. Still, Netflix was a very close second: For those who subscribe to a traditional TV package, basic cable was the top response (26%), followed by Netflix (24%) and broadcast TV (19%).

“Over the long term, assuming [Netflix] is able to continue to increasingly offer great content, this lead clearly bodes well for further value creation,” Cowen & Co. analysts led by John Blackledge wrote in a research note Tuesday.

Netflix continues to pump out an enormous amount of original content — all told, it’s on pace to spend $13 billion on content in 2018, Cowen & Co. estimates. (Netflix has projected content spending for the year of up to $8 billion on a profit/loss basis.)

In the second quarter of 2018, Netflix released around 452 hours of U.S. original programming, up 51% year-over-year but actually slightly under the company’s record output of 483 hours in Q1 2018. In Q2, Netflix’s originals slate included “Thirteen Reasons Why” season 2, “Luke Cage” season 2, and “Unbreakable Kimmy Schmidt” season 4, in addition to the reboot of “Lost in Space” and second seasons of drug war docu-series “Dope” and Brazilian dystopian series “3%.”

Netflix is scheduled to report second quarter 2018 results on Monday, July 16, after market close. The company has forecast net adds of 5 million international subscribers and 1.2 million U.S. subs.

Cowen & Co.’s Blackledge is particularly bullish on Netflix’s international prospects, raising the long-term price target on the company’s shares from $375 to $430 per share. The firm expects Netflix international subs to grow from 83.6 million at the end of 2018 to 255.2 million in 2028 (up from its previous estimate of 243.9 million).

“Owning a leading international content-production footprint and ramping relationships across the talent ecosystem should prove beneficial to NFLX’s ability to increase production in those markets, much of which is produced at a lower cost than similar content produced in Hollywood,” the Cowen & Co. analysts wrote.