By EMILY STEELJULY

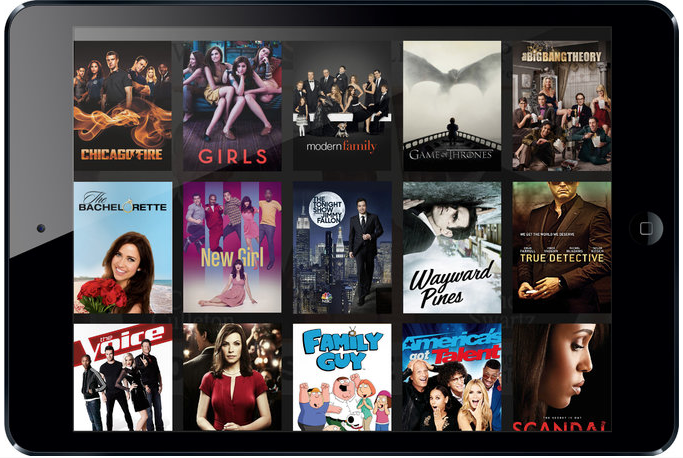

At first, Comcast’s Stream service will be offered in three cities and include programs from about a dozen networks.CreditComcast

Comcast, the country’s largest cable operator, is responding to the rush of new streaming television alternatives with the start of its own web-based offering that includes a bundle of broadcast networks and the premium cable network HBO.

The new service, which costs $15 a month, represents a bid from a mainstream cable company to stay relevant to a new generation of viewers. Many consumers — especially younger ones — are willing to pay for Internet service but are ditching cable packages in favor of streaming services that are often cheaper and offer more flexibility than the typical cable bundle.

At the Head of the Pack, HBO Shows the Way ForwardAPRIL 12, 2015

For an extra $15 a month added to a Comcast Internet subscription, viewers will have access to live and on-demand programming on computers and mobile devices from about a dozen networks, along with cloud DVR storage and Streampix, Comcast’s movie offering. Called Stream, the new service will be available in Boston, Chicago and Seattle later this year and across the company’s coverage areas in the United States in 2016.

Suddenly, Plenty of Options for Cord Cutters. Here are some prominent services offering live TV, à la carte networks and other on-demand streaming options.

“Clearly, there are changes that are happening in the market,” said Matthew Strauss, Comcast Cable’s executive vice president and general manager of video services. “Not everybody is going to want a full pay-TV bundle.”

There are limitations, however, that could curb the new service’s appeal to potential subscribers. To start, Comcast’s streaming service will not include any cable networks beyond HBO. That excludes networks like the sports hub ESPN and AMC, home to the zombie-apocalypse hit “The Walking Dead.” The broadcast networks — ABC, CBS, Fox, NBC and PBS — along with several other networks, are typically available free via high-definition antennas that cost about $25.

Subscribers to the Comcast app will not be able to stream the service to their television sets, an option for most other rival streaming services. (There is a workaround. Customers could use their account details to unlock access to network apps, like HBO Go, that are available for streaming to television sets.) Also, people who live in areas where Comcast is not the cable provider will not be able to subscribe to the service.

Mr. Strauss said that people seeking a broader lineup of channels and the ability to watch on their TVs had the option of subscribing to Comcast’s standard cable package. He added that the new offering was aimed at younger consumers keen to watch TV on computers and mobile devices.

He also said that the service was more convenient for customers, who will have the option to sign up and cancel online and will not need equipment or technician visits.

He said the service could eventually include the option to substitute other premium cable networks for HBO and to add packages of children’s, sports, lifestyle and movie programming for an extra $5 to $10 a month.

“We’re becoming much, much, much more surgical in how we target products,” he said.

With its new service, Comcast adds one more option to the explosion of new streaming offerings introduced in the last year that give viewers more flexibility to pay for the television they want to watch and decide how they want to watch it. These includes Sling TV, from the satellite provider Dish Network, which offers about 20 channels in a core package and add-ons for an extra $5 a month. Sling TV includes cable but not broadcast networks.

HBO, Showtime and CBS have also introduced à la carte streaming offerings that do not require standard cable subscriptions.

Whether people are lining up to pay for these new services remains unclear; the companies are releasing few figures on the number of subscribers.

At the same time, Netflix, Amazon and Hulu are pouring hundreds of millions of dollars into expanding their streaming offerings with deeper libraries and more exclusive and original television and movie content. Netflix counted 40.3 million paid members in the United States in the first quarter of the year. Hulu had nine million paying subscribers as of April.

The streaming services pose a threat to the entrenched cable business, which is steadily gaining broadband subscribers but is battling to hold on to video subscribers. The number of American households that pay for broadband service but not television increased 16 percent, to 10.7 million in 2014, from 9.2 million in 2012, according to SNL Kagan.

Comcast hit a major turning point in the second quarter of this year when the number of people who subscribed to its Internet service surpassed its total video subscribers for the first time.

Mr. Strauss said plans for the new service had been in the works for several months. Comcast aborted its $45 billion takeover of Time Warner Cable in April. The deal would have united the country’s two largest cable operators, but it set off regulatory concerns that the combined company would wield too much power over the Internet and have both the incentive and the ability to thwart competition in the market for online video.

Other cable operators have experimented with products aimed at appealing to the so-called cord cutters, who have canceled their cable packages but watch television via the Internet, or cord nevers, who never subscribed at all.

Cablevision, for instance, introduced a $35-a-month “cord cutter” package in April that includes Internet service, a digital antenna and the option to add HBO’s streaming service. Two years ago, Cox Communications tested a streaming service, also for $35 a month, that included access to about 100 channels and cloud DVR. The company ultimately did not go forward with the service.