What a difference 5 years can make. In 2010 pay TV had a virtual monopoly on the delivery of video to home. Today, things are radically different. Digitalsmiths Q3 2015 Video Trends Report shows alternatives to pay TV abound, and that OTT alternatives are even breathing life into the oldest of video delivery mechanisms.

Back in 2010, pay TV penetration hit an all-time high of 85%, the number of people watching over-the-air TV dipped below 11 million, and OTT video was a niche activity focused on user-generated content. For the majority of Americans, if they wanted to watch television they needed to have pay TV.

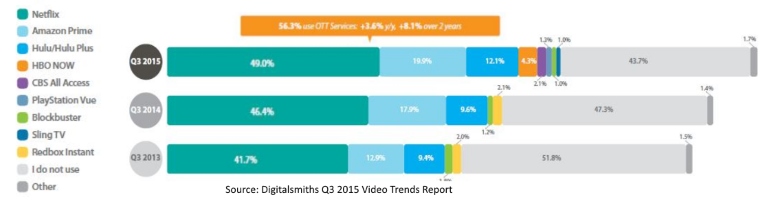

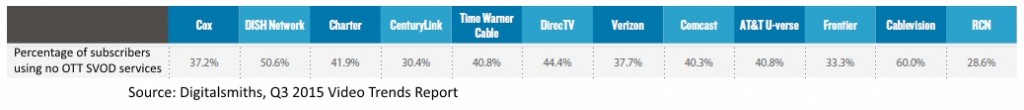

The latest Digitalsmiths data shows that the majority of Americans (56.3%) have subscribed to at least one OTT SVOD service. Half have a subscription to Netflix, 20% to Amazon Prime Instant Video, and 12% to Hulu. This also suggests that the majority of pay TV operator customers have an SVOD service. However, Digitalsmiths shows that all pay TV operators are not equal in this regard. For example, Dish Network and Cablevision* have the fewest number of SVOD customers in their subscriber base (50% and 40% respectively.) RCN and Century Link have the highest penetration of SVOD customers in their subscriber base (71% and 70% respectively).

While generally consumers don’t view SVOD services as direct replacements for pay TV, other services are explicitly pitching themselves as alternatives. Sling TV and Playstation Vue both provide live cable TV channels online. Awareness of these channels is still relatively low, with just 12% reporting they know about Sling TV and 9% recognizing Playstation Vue. However, looking at the broader context of replacement TV services online, awareness is very broad. Hulu, HBO Now and CBS All Access duplicate some content available through pay TV subscriptions in direct-to-consumer SVOD services. Including these services, we see that 63% of US consumers are aware of at least one of them.

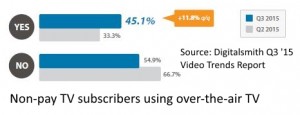

One remarkable fact highlighted in the report is the growth in use of over-the-air (OTA) TV among those without a pay TV subscription. Of the 16 million or so homes that do not have pay television, 45.1% say they use over-the-air broadcasts to watch at least some of their TV. That’s a 12% increase over the previous quarter. What could be driving this increase? Those using SVOD services alone have been missing the ability to watch live events, such as professional sports and awards shows like the Oscars. It has been difficult to combine these two disparate delivery mechanisms until recently. However, in the last year providers such as TiVo, ChannelMaster, and TabletTV are making it very easy to combine SVOD and OTA TV.

One interesting thing to note from the data is that the decision to cut the cord does not seem to be irrevocable. Digitalsmiths says 19% of those without pay TV cut the cord in the last year, which is in close agreement with Leichtman Research Group’s estimate of 17%. That would suggest several million households fell out of the pay TV fold during that period. However, Leichtman data estimates pay TV losses between Q3 2014and Q3 2015 at 400,000. Even accounting for new home formation, this suggests many people that cancel pay TV later decide to re-subscribe.

Today, there are now plenty of other sources for TV content outside of the pay TV ecosystem. Digitalsmiths data makes it clear that consumers are happily embracing them.

Why it matters

Unlike the situation 5 years ago, when there was little alternative to pay TV, today there are plenty of online sources for premium TV.

Consumers are embracing these sources, and beginning to rediscover free over-the-air broadcasts.

This combination pose a potent challenge to pay TV service.

*Digitsmiths said that, particularly in Cablevision’s case, they had very few survey respondents in the operator’s service area. The reader should, therefore, treat these numbers with care.